How much do you need to worry about interest rates?

If you are old enough you will remember a time when interest rates in Australia were in the high teens. It was not unusual for lenders to be charging 17 per cent for home loans and business loans had equally harrowing rates.

Suddenly in 2022 after over 10 years of low rates, I am hearing talk of ‘rate hikes’ from economists and media pundits. It is clear that there will be an uptick in interest rates this year but it is well worth considering any forecasts about the cost of borrowing, and the direction that cost is heading in, with some context.

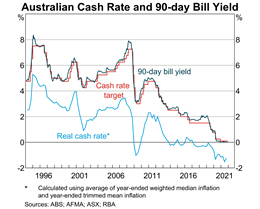

Let’s look at this graph from the Reserve Bank of Australia’s statistics pack as a starting point for any realistic discussion about how expensive it might become to borrow money for a large project – whether that’s in mining, property development, infrastructure, agriculture or any other major sector where the amount of capital required is substantial – millions or billions of dollars.

This graph clearly shows that, when it comes to interest rates, we are at the very bottom of a trend that may take decades to change in a substantive way. Of course, it is true to say that even a one quarter or one half per cent rate increase can hurt a borrower who is operating on the edge of his or her seat. However, that is not likely to be a borrower with a pipeline of large projects in their given field.

The big dip between 2006 and 2011 was, of course, the Global Financial Crisis. The gap between the real cash rate and the RBA’s cash rate target shows that, yes, indeed the RBA would like to see official interest rates rise. The recent return of inflation needs to be addressed with an official rate adjustment but low wage growth and the ongoing threat of COVID will underpin a conservative approach from the RBA.

The good news for borrowers is also clear from this graph. The cost of borrowing money is going to remain low in historic terms for the foreseeable future. Setting aside any unpredictable catastrophe – and given we are only inching toward moving from the pandemic to endemic phase of the global COVID-19 crisis – there are never any guarantees about market movements.

All things considered the price of borrowing money, which is the interest charged by the lender and paid by the borrower, will not escalate overnight. It is a slow-moving train and one that is quite easy to trace and predict.

It also helps if, when planning your next major project, be it finance for a major property development, public-private partnership, exploration or mining, to name a few of the sectors we assist, you can maximise your chances of getting the very best finance deal possible if you don’t confine yourself to one lender – even if you have been doing business with that one lender since interest rates were 17 per cent!

At Acuity Funding we have relationships with large private investors from around the globe in addition to long-standing relationships with conventional lenders. When negotiating finance for a major project it is perfectly acceptable, in fact it is prudent, to work with an expert who can drive the best deal possible on your behalf.

Irrespective of where we are in the interest rate cycle – and we have been around long enough to see it all – Acuity Funding has the expertise and the relationships to make sure you pay the lowest possible cost for the capital you need to borrow. Please reach out to discuss your requirements.